Michigan Employee Withholding Form 2025. The lowering mi costs plan (public act 4 of 2025) was signed into law on march 7, 2025, and will amend michigan’s current income tax act to provide a substantial tax deduction. We explain the five steps to filling it out and answer other faq about the form.

1 published the 2025 corporate income and individual income tax withholding tables. Federal income withholding tax brackets remain at 10, 12, 22, 24, 32, 35, and 37%.

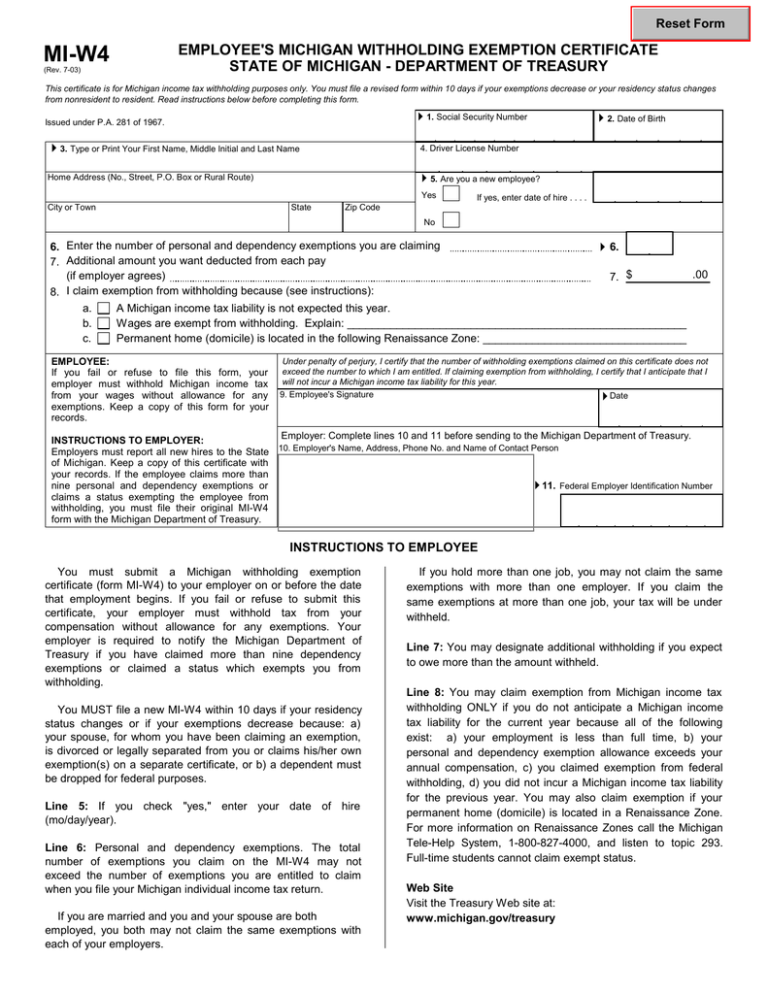

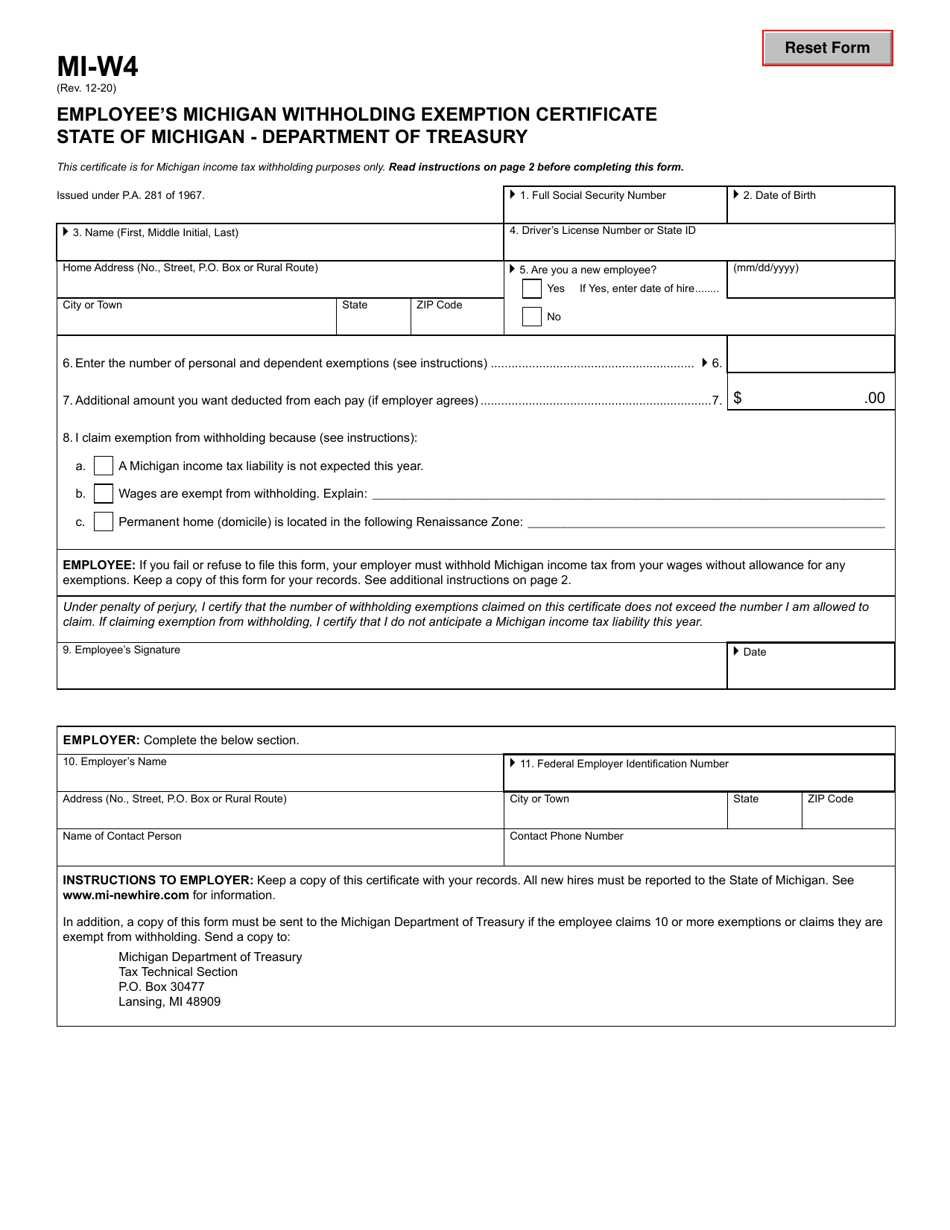

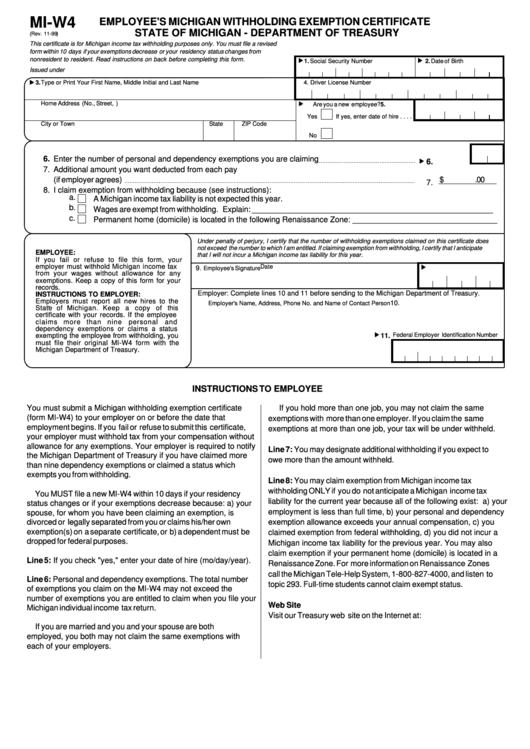

Form MIW4 Download Fillable PDF or Fill Online Employee's Michigan, The michigan department of treasury nov. As to whether employers can withhold at the lower rate of 4.05% in the absence of updated 2025 withholding tables, the department stated that employers have.

State Of Michigan Annual Withholding Form, Employees of the university of michigan who perform services solely in one of the following states are required to submit a state withholding allowance certificate to the payroll. As to whether employers can withhold at the lower rate of 4.05% in the absence of updated 2025 withholding tables, the department stated that employers have.

w4formemployeeswithholdingcertificate pdfFiller Blog, The income tax withholding formula for the state of michigan includes the following changes: The correct amount of withholding depends on income earned from all of these jobs.

W4 Form 2025 Printable Employee's Withholding Certificate W4 2025, Form dw4 employee withholding certificate & instructions. Stoneridge, inc., headquartered in novi, michigan, is a global designer and.

Form 2025 Instructions 2025 Schedule B carlin abigale, As to whether employers can withhold at the lower rate of 4.05% in the absence of updated 2025 withholding tables, the department stated that employers have. The tables reflect weekly, bi.

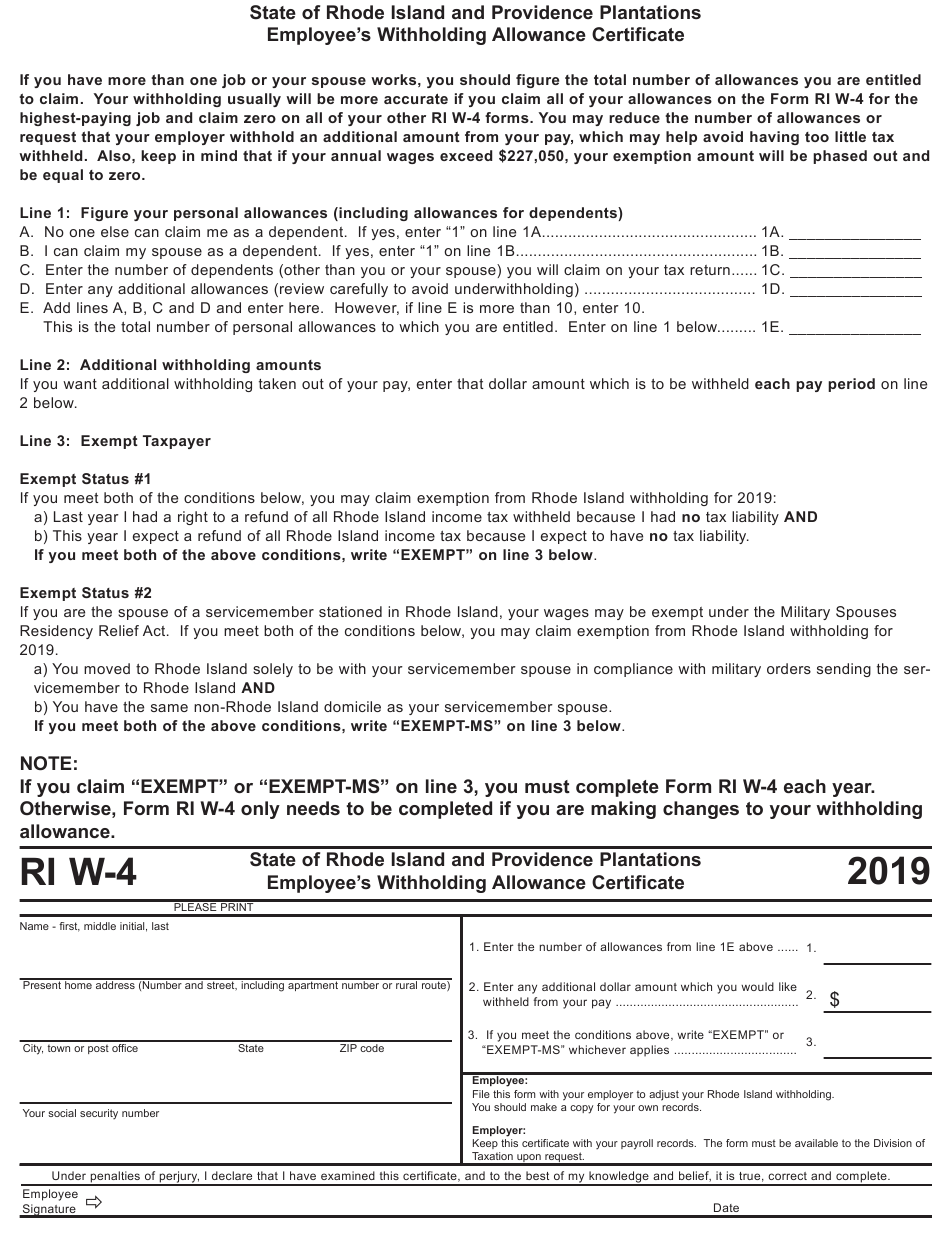

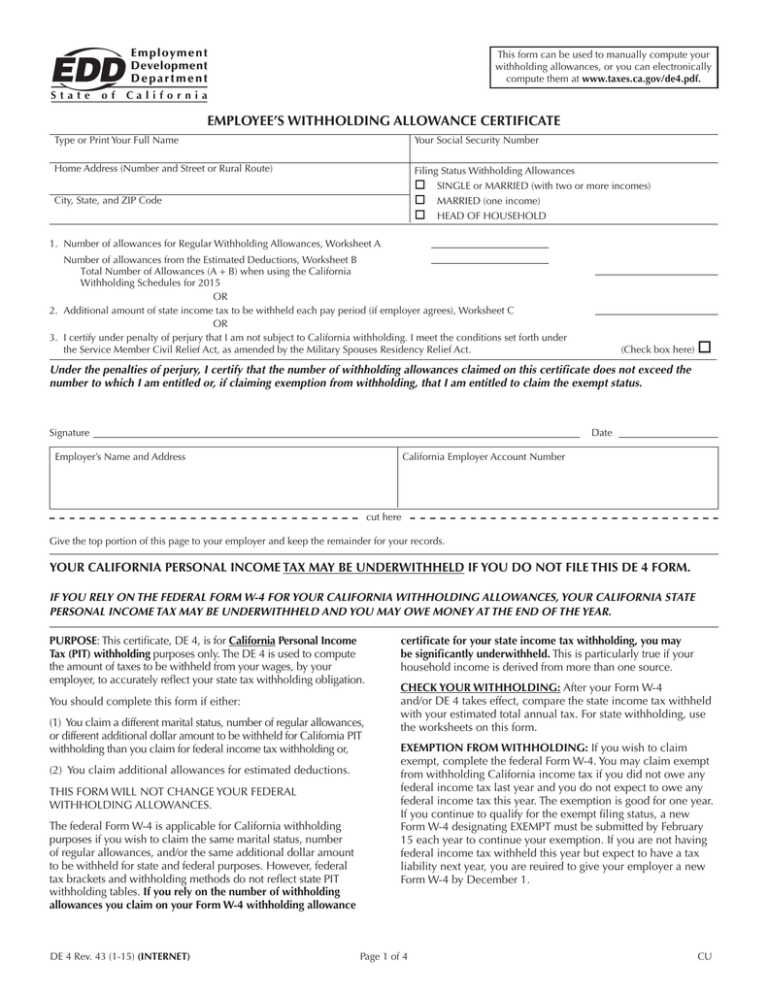

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE, The michigan department of treasury issued a release that discusses the tax treatment of retirement and pension income following changes to mich. The lowering mi costs plan (public act 4 of 2025) was signed into law on march 7, 2025, and will amend michigan’s current income tax act to provide a substantial tax deduction.

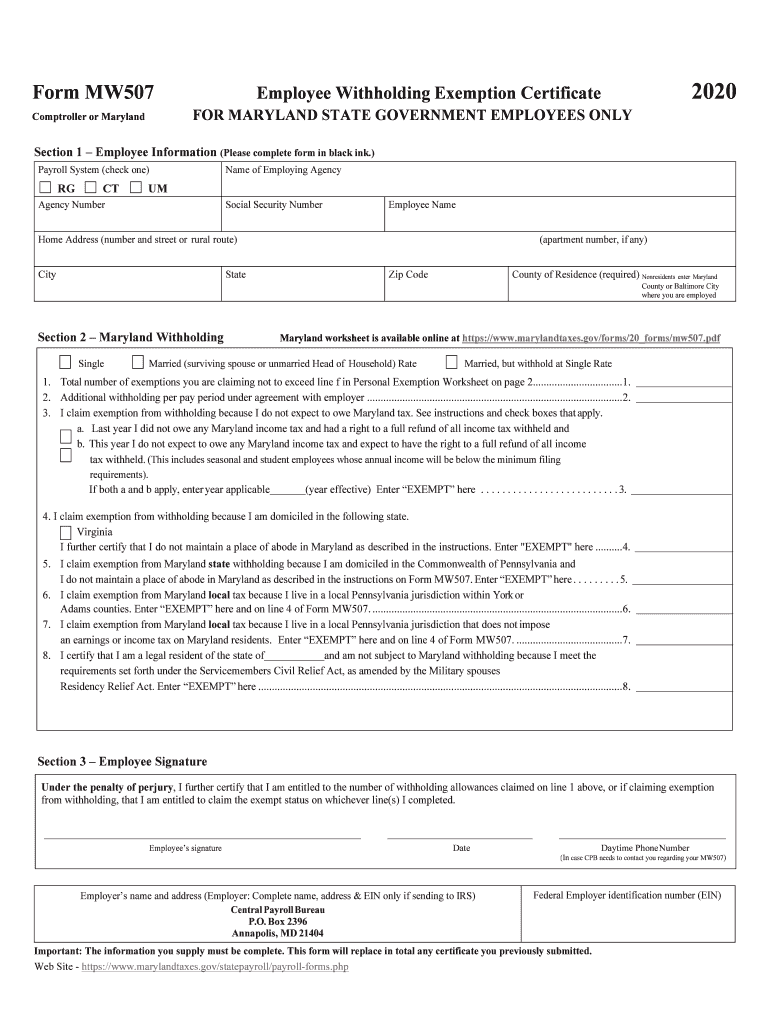

Maryland Employee Withholding Form 2025 Printable Forms Free Online, Do only one of the following. The correct amount of withholding depends on income earned from all of these jobs.

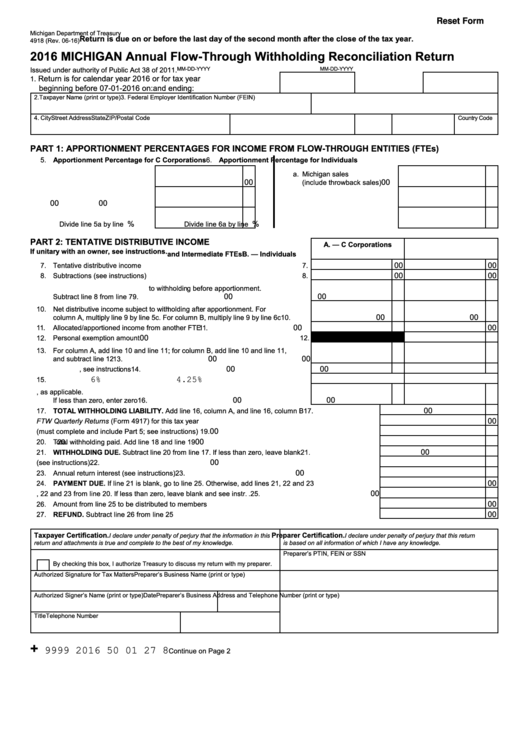

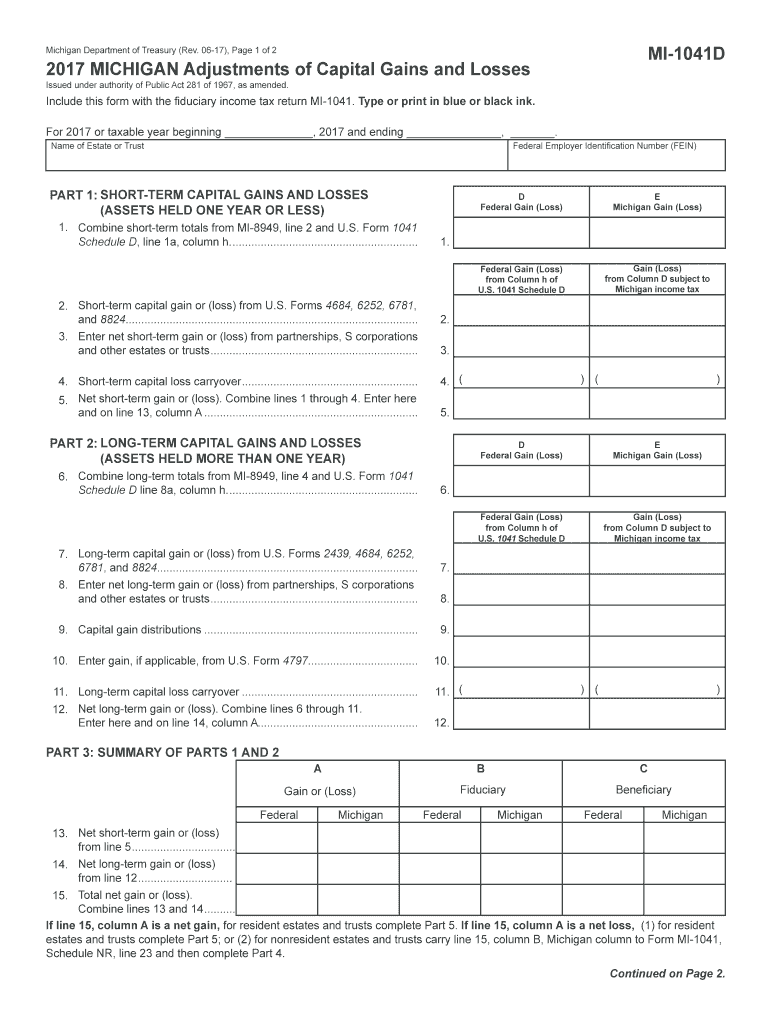

Mi 1041d 20172024 Form Fill Out and Sign Printable PDF Template, If you are not redirected please download directly from the link provided. The michigan department of treasury issued a release that discusses the tax treatment of retirement and pension income following changes to mich.

State Tax Employee Withholding Forms For All States, 2025 michigan income tax withholding tables: As to whether employers can withhold at the lower rate of 4.05% in the absence of updated 2025 withholding tables, the department stated that employers have.

MIW4 EMPLOYEE'S MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE, The michigan department of treasury released an updated 2025 individual income tax withholding guide. The state of michigan’s payroll withholding tax rate is 4.25%.